arizona residential solar energy tax credit

The total cost of your solar panels depends on several factors such as which manufacturer you use and the size of your roof. The Residential Arizona Solar Tax Credit reimburses you 25 of the cost of your solar panels and up to 1000 on your personal income tax in the year you install.

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit.

. The Center for Sustainable Energy reports the average cost of a residential solar system is between 15000-25000. In addition to the federal solar tax credits some utility companies or local governments offer solar energy incentives. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

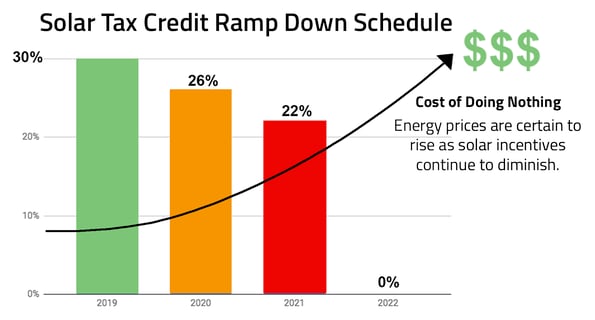

An income tax credit for the installation of solar energy devices in Arizona business facilities. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. The percentage you can claim depends on when you installed the equipment.

Although this tax credit is intended to cover up to 30 percent of. There could also be local incentives from your utility company and the federal tax credit that could lower. Solar industry has grown by more than 10000 with an average annual growth of 50 over.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Like the temporary Residential Renewable Energy Tax Credit which applies to up to 30 percent of your installation. The federal tax credit falls to 22 at the end of 2022.

By leasing instead of selling the solar panels solar corporations get to keep the tax credit. If another device is installed in a later year the cumulative credit cannot exceed 1000 for the same residence. Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property. 2022s Top Solar. Theres no cap on the federal tax credit and it can be claimed over multiple years if necessary.

26 for equipment placed in service between 2020 and 2022. Residential Solar Energy Credit. Equipment and property tax exemptions.

Arizona State Energy Tax Credits. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. 026 18000 - 1000 4420.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost. An Arizona income tax credit is offered to businesses that install one or more solar energy devices in their Arizona facilities.

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance. Find other Arizona solar and renewable energy rebates and incentives on Clean Energy Authority. 30 for equipment placed in service between 2017 and 2019.

A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance with ARS. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits. Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation. Cost of solar panels in Arizona.

This is 26 off the entire cost of the system including equipment labor and permitting. 23 rows A nonrefundable individual tax credit for an individual who installs a. The Arizona Residential Solar Tax Credit for example can reduce the cost of a solar panel system by 1000.

The residential tax credit is administered solely by Revenue. Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500.

This means that in 2017 you can still get a major discounted price for your. In the years since the US. The federal government enacted the solar Investment Tax Credit ITC in 2006.

Residential Solar and Wind Energy Systems Tax Credit. The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a. Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels.

The Arizona Department of Revenue ADOR is advising homeowners who installed solar energy devices in their homes throughout 2021 to submit Forms 310 and 301 to receive an income tax credit. 22 for equipment placed in service in 2023. Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive program for the State market.

The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. You can claim the credit for your primary residence vacation home and for either an existing structure or. The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1000 maximum allowable limit regardless of the number of.

The Renewable Energy Production tax credit is for a. Affirming its commitment to the development of renewable energy resources the Arizona legislature recently passed legislation exempting the sale andor use of Renewable Energy Credits generally referred as RECs from Arizonas transaction privilege tax which operates similar to a sales tax. When it comes to Arizonas solar energy existing financial incentives and policy only make it more lucrative for you to sustainably increase your property value.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Residential arizona solar tax credit one of the most important incentives to help. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows.

Given that Arizonas state transaction privilege tax is over seven. Refer to the DSIRE database to determine if there are any local solar incentives in your area.

Arizona Solar Tax Credits And Incentives Guide 2022

Solar Incentives Southface Solar Phoenix Az

3 Solar Incentives To Take Advantage Of Before They Re Gone

Is Solar In Arizona Actually Free

Solar Panel Tax Credits Home Solar Panel Tax Credits

Income Tax Credit For Residential Solar Devices Arizona Department Of Revenue Prescott Enews

3 Solar Incentives To Take Advantage Of Before They Re Gone

Residential Solar Panels Energy Solution Providers Az

The Solar Investment Tax Credit In 2022 Southface Solar Az

Free Solar Panels Arizona What S The Catch How To Get

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Solar Carport Tax Credits Inty Power

How To Take Advantage Of Solar Tax Credits Earth911

Solar Tax Credit In 2021 Southface Solar Electric Az

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home